I’m not who I think I am. My identity is a fraud. Sort of.

Well, that’s not entirely true. I know who I am, but apparently I am also someone else. Or rather, someone else wants to be me.

I’ll explain.

In the midst of a very busy afternoon, a disturbing piece of mail is presented to me via the in-laws, who happen to live across the street. Apparently, a Verizon bill has arrived to their address, with a name technically similar to mine. And apparently, a brand new Blackberry has been purchased, along with a nifty new phone & text plan.

Cool, right? If it’d been ME that actually opened it, then sure. But NOPE.

So I call Verizon. And once I manage to get a human being on the line, I’m told that in order to access my “new” account, I need to provide them with the last four digits of my social security number…

Me: “Ok. I’ll give them… but they’d BETTER not work….” *rattle off the four numbers*

Verizon Rep: “They’re correct. How can I help you today?”

If you’ve ever had your identity stolen, then you know just how much this blows. And if you haven’t, just….. don’t. Because it really blows.

But here’s what is so difficult. It’s not just the myriad of phone calls, emails, and paperwork that follow. It’s the feeling of total vulnerability. The reality that someone is out there, masquerading as…. YOU…. is quite a head trip.

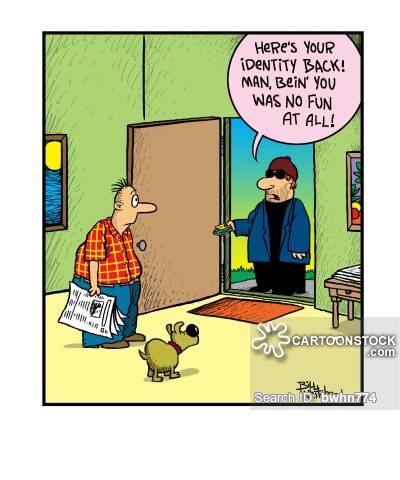

My thought was, why MY identity? Good luck with that, thief. Because there are days when even I don’t want to be me. But my feeling is that if you’re going to be me, well then, you need to…. BE ME. Yup. The whole package. You can have the cool new phone, but you also need to adopt the tens of thousands of student loan debt. You’re welcome. 🙂

It makes you wonder. Who’s walking into a store, acting all “me” like? And why does she have a cooler phone than ME now?? Your mind alternates between being totally creeped out and wanting to hunt the perp down. Sort of like this:

http://www.youtube.com/watch?v=KcvIpsf-ENY

I’ll spare you the gory details of every phone call that I needed to take in getting this resolved. And thankfully, it seems so far that the theft was limited to the one incident. What disturbed me immensely, however, is just how common identity fraud is.

The Verizon rep had it happen to her. One of my best friends did, too.So did the first police officer I spoke to. And the second.

The point? People really, really love to steal stuff. Especially phone stuff.

Obviously with everything online these days, your personal information is at risk. Identity fraud happens SO often- far more often than I ever knew.

So here’s the thing. You can’t necessarily prevent identity fraud from happening to you, but here’s what you CAN do if it does occur:

- Obtain a copy of your credit report. You are entitled to one free copy of your report per calendar year, so if you haven’t yet checked yours out, then take advantage of www.annualcreditreport.com. Check your accounts carefully- there can be errors in it regardless of fraud! Or, you can find out that you still have an active Sears card from, say, 1998, that you’ll never, ever, ever use again (Just me?)

- Place a fraud alert with the Big Three credit agencies. The three main credit agencies responsible for monitoring your credit are Experian, TransUnion, and Equifax. If you suspect that your information has been used fraudulently, then call any on of the three agencies; you can use their automated service to place a fraud alert on your credit for 90 days. Once you’ve done so, any inquiries/potential credit usages are not permitted unless authorized by YOU- via your phone number. If you contact one agency, they will then alert the remaining two agencies.

Experian: 888-397-3742

- File a police report. Contact your local police precinct prior to doing so, because every precinct differs in precisely what information they require in order to be able to file a report for you.

- Keep copies/logs of EVERYTHING: Make a file to keep a photocopy of EVERY single document associated with your issue. Log what calls you make, & the name of the representative that you speak with. You don’t want to get stuck footing a massive fraudulent Apple bill simply because you lost pertinent information. And while Verizon was cooperative in helping me to resolve this quickly, not every company is as accommodating.

I’m not going to lie & say that this incident doesn’t make me super-paranoid about where & when my personal information is shared, now & in the future. What I CAN tell you is that once the initial panic subsided, taking immediate action and formulating a planned response really helped me to feel less violated.

Your personal identity can be stolen in so many ways these days. But try to avoid making it too easy for thieves. Change your online passwords frequently. Avoid using your sensitive information (social security number, driver’s license ID, etc.) unless absolutely required by a proven legitimate site. Check your credit report frequently to gauge any odd activity. Opt to use credit rather than debit on your bank cards. And if something goes awry, ACT FAST.

So hopefully I’m out of the woods in terms of my identity crisis… but like I said- if the thief wants my (so far) unblemished credit, than he/she also needs to take the student loan debt, the six kids, the daily spilled milk, the endless laundry, the soccer practice runs, the math homework assistance…. no mercy.

© Copyright 2014 Six Pack Mom, All rights Reserved. Written For: SPM Writes

Leave a Reply